Stock Market Simulation Crack & Activation Code

Stock Market Simulation is a Java tool that was created as a response to the following problem.

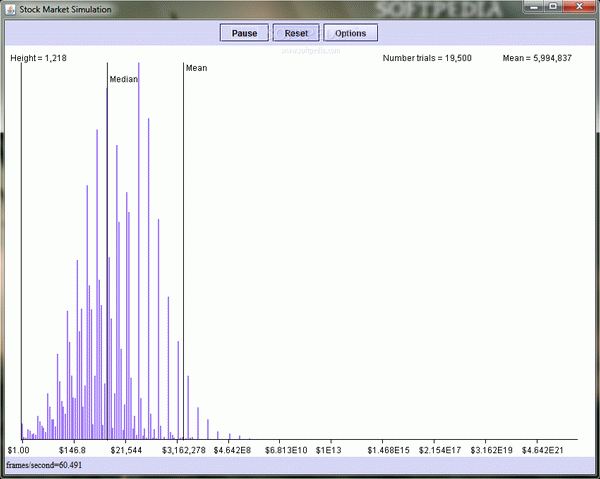

For example, if you invest $100,000 in a volatile stock. Each year, with equal probability, it either rises 60% or falls by 40%. You declare that your heirs are not to sell the stock for 100 years. What would be the expected stock value (mean) after 100 years? What would be the median? What would be the mode?

Download Stock Market Simulation Crack

| Software developer |

Barry G. Becker

|

| Grade |

4.0

862

4.0

|

| Downloads count | 7124 |

| File size | < 1 MB |

| Systems | Windows All |

The expected value would be $1,378,000,000. If there are many stocks like this, the total market value will rise dramatically (value = expected * num_stocks)

100,000 * ((1.6+0.6)/2)^100 = 100,000 * 1.1^100

The mode and the median are both $13,000 (100,000 * (1.6)^50 * (0.6)^50).

While on average you expect a 10% return a year, the most likely scenario (mode) is that you'll end up with $13,000. Moreover, more than half the people will end up with $13,000 or less.